If you’re a resident of New Jersey or planning to visit, it’s essential to understand New Jersey e cigarette laws. These regulations not only help protect public health but also ensure safety among users of electronic cigarettes or vaping devices. The state has taken specific measures to regulate the sale, use, and advertising of these products. Knowing these laws can help you stay compliant and avoid potential penalties.

New Jersey is one of the states that have adopted a stringent approach towards e cigarette regulations. The key points include age restrictions, locations where vaping is prohibited, taxation, and advertising rules. Let’s delve deeper into each aspect to provide a comprehensive understanding.

Age Restrictions

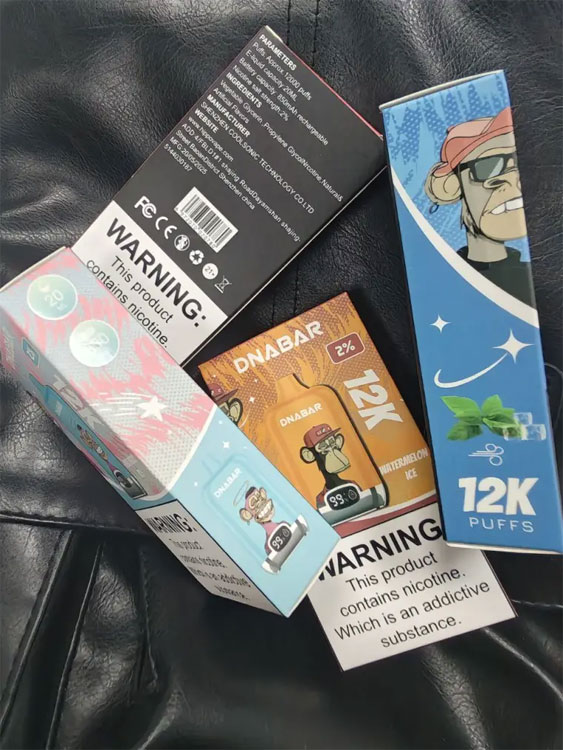

In New Jersey, the purchase of electronic cigarettes and vaping products is restricted to individuals who are at least 21 years old. This law aims to prevent minors from accessing these products, safeguarding their health from potential effects associated with nicotine consumption. Retailers are responsible for verifying the age of buyers through official identification. Failure to comply can result in fines or license revocation.

The strict age limit reinforces the state’s commitment to youth protection. Parents are encouraged to talk to their children about the risks associated with vaping and nicotine dependency, even if purchasing is illegal for them.

Prohibited Areas

New Jersey’s smoke-free air legislation includes vaping restrictions similar to traditional smoking. Vaping is prohibited in many public places, including restaurants, bars, and workplaces. Additionally, educational facilities and public modes of transportation adhere to these restrictions to promote a healthier environment. This means you’ll need to actively look for designated smoking or vaping areas.

similar to traditional smoking. Vaping is prohibited in many public places, including restaurants, bars, and workplaces. Additionally, educational facilities and public modes of transportation adhere to these restrictions to promote a healthier environment. This means you’ll need to actively look for designated smoking or vaping areas.

Moreover, the law covers outdoor spaces, such as public parks and beaches, reinforcing the policy of clean air in diverse environments. Violating these laws can lead to fines ranging from $250 to $1,000, depending on the frequency of offense.

Taxation

Electronic cigarettes and vaping products in New Jersey incur a tax similar to tobacco products. This tax aims to discourage excessive consumption and contribute to public health funding. Retailers must ensure that taxes are adequately applied and recorded, as inaccuracies could result in penalties or audits.

similar to tobacco products. This tax aims to discourage excessive consumption and contribute to public health funding. Retailers must ensure that taxes are adequately applied and recorded, as inaccuracies could result in penalties or audits.

Consumers may notice a slight increase in the overall cost of products due to taxation, which reflects the state’s effort to balance public health concerns with revenue generation.

Advertising Regulations

Advertising e cigarettes in New Jersey is subject to strict rules. Promotions targeted at minors or using misleading health claims are prohibited. Advertisements must adhere to truthful communication and avoid suggesting that vaping is safer than smoking traditional tobacco products. Compliance is mandatory for manufacturers and retailers alike, ensuring honest representation to prevent public misconception.

Companies found in violation may face substantial fines or legal action, signaling New Jersey’s commitment to ethical marketing practices and consumer protection.

FAQ

- What happens if a retailer sells e cigarettes to minors? Retailers face fines, potential license revocation, and legal repercussions for selling to minors, given the strict enforcement of age restriction laws.

- Can you vape in your own vehicle? While personal vehicles don’t fall under public space restrictions, it’s essential to respect passenger requirements, as vaping may cause discomfort or health issues for non-users.

- Are there any exemptions to vaping bans? Some private clubs and specialized shops may have exemptions, but it’s vital to verify compliance with state regulations to avoid penalties.